To increase food supply and stabilise the nation’s food prices, the federal government has completed plans to release an extra 60,000 metric tonnes of food grains.

At the Public Wealth Management Conference, which was hosted by the Ministry of Finance and the Ministry of Finance Incorporated (MoFI), on Tuesday, February 20, in Abuja, Minister of Finance and Coordinating Minister for the Economy, Wale Edun, disclosed this.

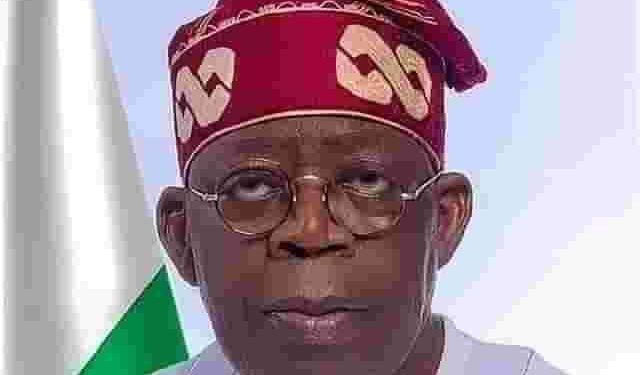

In his speech, Edun stated that President Tinubu is dedicated to helping the less fortunate in these difficult times.

He declared that President Tinubu “is currently releasing 42,000 metric tonnes of food grains, with plans for an additional 60,000 tonnes,” in addition to having “previously released strategic grain reserves.”

According to the minister, these steps are intended to guarantee food supply and stabilise prices in the hopes that they will eventually fall. No matter how much work is involved, the main goal is to get food onto people’s tables and into the market.

Edun states that “President Tinubu has always stated he will not leave the poor, the weaker, and the vulnerable in society at times like this. In addition to the 42,000 metric tonnes of food grains that he is currently releasing, he has previously released strategic grain reserves and plans to release an additional 60,000 tonnes.

“We expect food prices to stabilise and begin to fall in a reasonable period. In the meantime, we will do everything within our power to put food on people’s tables.” This is in addition to steps taken to ensure that whatever is in the stores is released at this crucial time.

The finance minister discussed the executive order that was put into effect, enabling the Ministry of Finance to offer government-backed securities through the Debt Management Office (DMO).

With this programme, Nigerians will be able to save in dollars and the Naira will regain some of its lost value, both domestically and internationally. People can show their support for Nigeria and keep their savings in US dollars by purchasing securities denominated in US dollars.

He also discussed the joint efforts of the monetary and fiscal authorities in Nigeria to tackle economic issues. He emphasised how the Ministry of Finance’s response, which included debt management techniques, raised the interest rate on Treasury bills and so enhanced the flow of dollars into the economy.

He said that the collaboration of monetary and fiscal policies shows a determined attempt to lower interest rates and stabilise the economy, as well as to draw in foreign direct investment and portfolio investments.

According to Dr. Shamsudeen Usman, the chairman of the MOFI Board, MOFI will now manage its assets more actively. Rather than as rivals or authorities, he urged asset operators to see MOFI as partners.

Additionally, Usman guaranteed MOFI’s dedication to strict corporate governance guidelines, which include a rule against employee conflicts of interest.

The CEO of MOFI, Dr. Armstrong Takang, outlined MOFI’s renewed mandate, focusing on expectations from both the public and private sectors. He announced the launch of a N100 billion Project Preparation Fund aimed at improving the professionalism in managing public assets.

The goal, he said is to generate commercial value for the benefit of the people and enhance investor confidence in the assets’ operations and management